Investors | Find your HR Website

The Plan

Removes the Guesswork

One Provider - One Platform - One Powerful Solution

At Benefit Boost Consulting, our mission has been to help businesses identify the most effective benefit solutions available in today’s market.

While we’ve traditionally offered clients a curated selection of provider options, the current landscape has made one choice overwhelmingly clear.

Disclosure:

Benefit Boost Consulting is not a licensed insurance agency and does not sell insurance products. We connect employers with vetted third-party providers offering zero out-of-pocket benefit solutions.

Given the unparalleled credentials of this particular Provider—including exclusive national program approval, more than 20 years of experience, and fully insured coverage—we've determined that offering alternative options would not serve our clients’ best interests.

What began as a premier collaboration has evolved into a trusted, exclusive relationship. As a result, this Provider is now our singular recommendation in this category—until another emerges with comparable qualifications.

What Makes Our Provider Stand Out?

✔️ Fully Insured Structure – Predictable costs, lower risk, and carrier-backed stability for employers.

✔️ Turnkey Implementation – Seamless onboarding, minimal HR lift, and hands-off administration.

✔️ Nationwide Accessibility – Available across the U.S. with flexible plan options.

✔️ Employee-Focused Delivery – Cash payouts, everyday usability, and straightforward claims processes.

✔️ Built for Compliance – Meets stringent industry standards and reporting requirements.

✔️ Aligned with Our Mission – Zero out-of-pocket solutions that deliver maximum employer impact.

Our Provider’s Plan

Program Minimum Requirements- Companies Employing 10+ W-2 Employees

Meet “THE PLAN” That Changes Employee Benefits Forever

“THE PLAN” Helps Employers Attract Talent, Reduce Turnover

and Boost Wellness—Without Touching Their Budget.

Provider specializes in reducing healthcare expenses through the implementation of an innovative Section 125 plan—commonly known as a Cafeteria Plan.

This structure allows employees to pay for supplemental benefits with pre-tax dollars, lowering their taxable income while increasing their take-home pay. At the same time, employers benefit from reduced payroll taxes.

Through this strategic model, both employers and employees gain enhanced financial flexibility and a more efficient way to manage healthcare expenses. On average, businesses can save, through tax incentives, between $600 and $900 per employee per year with this approach.

It’s a win-win

Comprehensive supplemental coverage for employees & measurable savings for the business.

PLAN HISTORY

Section 125 plans introduced to allow for health benefits on a Pretax basis.

Affordable Care Act launched to improve access to health coverage for individuals nationwide.

Wellness benefits added to the ACA allowing for the payment of specific wellness program activities.

Section 125 Indemnity benefit plans become fully insured products by major insurance carriers.

Our provider launches its fully insured plan and receives State approvals nationwide.

Even high-quality health plans can leave employees exposed to out-of-pocket costs from hospital stays, accidents, or serious illnesses. That’s where “THE PLAN” makes a difference—by covering these gaps and ensuring that unexpected medical expenses don’t become a source of stress.

This coverage works seamlessly alongside traditional health and life insurance, providing an extra layer of protection when it’s needed most. Whether someone’s facing an extended hospital stay, a critical diagnosis, or a sudden injury.

Our Provider’s plan is designed to reduce financial strain so employees can focus on healing.

It’s not just about benefits—it’s about peace of mind.

Even high-quality health plans can leave employees exposed to out-of-pocket costs from hospital stays, accidents, or serious illnesses. That’s where “THE PLAN” makes a difference—by covering these gaps and ensuring that unexpected medical expenses don’t become a source of stress.

This coverage works seamlessly alongside traditional health and life insurance, providing an extra layer of protection when it’s needed most. Whether someone’s facing an extended hospital stay, a critical diagnosis, or a sudden injury.

Our Provider’s plan is designed to reduce financial strain so employees can focus on healing.

It’s not just about benefits—it’s about peace of mind.

“THE PLAN’S” EMPLOYER BENEFITS

(Employer’s Benefits through “THE PLAN")

Tax Savings

Plan contributions are made with pre-tax dollars, typically saving employers $600–$900 per participant annually.

Reduced Turnover

Companies experience lower attrition rates through increased employee satisfaction and retention.

Higher Productivity

Healthier employees lead to improved performance and fewer sick days.

Positive Workplace Culture

Wellness-focused environments cultivate better morale and engagement.

Lower Healthcare Spend

Supplemental benefits offset out-of-pocket costs, easing the burden on traditional plans.

Compliance & Trust

All services and providers are vetted for transparency, aligning with employer standards.

Recruitment Edge

Offering zero-out-of-pocket benefits can be a differentiator in attracting top talent.

Seamless Benefit Integration

No impact on payroll or premiums - Boosts employee satisfaction and loyalty

Easy to implement with provider support - Enhances company culture and wellness

Empower your workforce with zero out-of-pocket benefits that elevate

morale, drive retention, and reinforce your commitment to employee wellbeing.”

“THE PLAN’S” EMPLOYEE BENEFITS

(Qualified Family Members Included)

Prescription Drug Plan

The Provider’s FREE Prescription Drug Plan turns unpredictable pharmacy bills into simple, fixed copays or coinsurance, capping out-of-pocket costs. With a robust formulary spanning generic and brand-name medications, employees never face barriers when filling prescriptions. For those on daily or long-term therapies, this plan locks in consistent, wallet-friendly access—so they can focus on their health, not the cost.

Telemedicine: Anytime Virtual Care for Body & Mind

Our Provider’s Telemedicine benefit delivers round-the-clock virtual access to board-certified physicians and licensed behavioral-health specialists anywhere in the U.S. Just activate your account and you are moments away from a secure video or phone visit with a doctor, psychologist, or psychiatrist.

Connect on demand for minor illnesses or mental-health concerns—no waiting rooms.

Schedule follow-ups when it suits you and join visits from your phone or computer.

Send prescriptions straight to your preferred pharmacy for easy pickup.

Skip ER and urgent-care lines while still getting expert diagnosis and treatment.

Virtual Veterinarian Services

Covered treatments are everything from colds, flu, and skin irritations to stress, anxiety, depression, trauma, and substance-use issues.

Partner with Our Provider to add Telemedicine to your benefits lineup—and give your team instant, confidential care whenever they need it.

Surgery & Anesthesia Benefit

Our Surgery & Anesthesia Benefit delivers a lump-sum payment of $1,000 for any inpatient surgical procedure—covering operating-room fees, hospital room and board, nursing care, and related services—plus an additional $400 cash benefit for professional anesthesia services. Together, these payouts ensure employees have the financial backing to focus on recovery rather than hospital bills.

This benefit is designed to sit alongside existing health coverage—especially high-deductible or limited-network plans—filling critical gaps without restricting hospital or provider choice. Employees can select any facility or surgeon, knowing they’ll receive both the inpatient surgery and anesthesia cash benefits when they need them most.

Partner with your Provider to add this Surgery & Anesthesia Benefit to your offerings and give your team comprehensive protection from admission through discharge.

Accident Plan

Our Provider’s Accident Plan delivers a $1,000 cash benefit for every covered accident—whether it leads to an inpatient hospital stay or an outpatient visit—so employees have immediate funds to offset deductibles, copays, and other unforeseen medical bills. This supplemental coverage sits on top of existing health insurance, filling gaps and easing the financial strain that follows an unexpected injury.

This Accident Plan gives employees and their families the freedom to focus on recovery instead of worrying about out-of-pocket costs.

Partner with your Provider to add this Accident Plan to your benefits lineup—and give your team the financial safety net they need when accidents happen.

Wellness Plan

Our Wellness Plan from your Provider gives employees the tools to take charge of their health with a comprehensive Health Risk Assessment, clear Risk Identification, and personalized Health Scores. These assessments pinpoint potential issues early—whether it’s rising blood pressure, stress triggers, or lifestyle gaps—and translate raw data into practical steps for disease prevention, stress management, and habit-building.

By weaving these insights into your benefits lineup, you empower your team to catch concerns before they escalate and to track progress over time.

Partner with your Provider to bring this Wellness Plan on board—and help your workforce build healthier routines, reduce chronic-disease costs, and enjoy lasting well-being.

Hospital Stay Support Plan

Unexpected hospital stays can lead to unexpected expenses. Our Hospital Stay Support Plan provides a daily cash benefit for each day of inpatient care—designed to ease the impact of high deductibles, limited coverage, or out-of-pocket costs that aren’t covered by traditional insurance.

Think of it as a financial buffer that complements your existing health benefits. Whether it's a short-term visit or a longer recovery, the additional support helps lighten the financial load, so you're not navigating stress on top of healing.

Best of all, you choose where to receive care. There are no network limitations, giving you the freedom to select the hospital or provider that best fits your needs. It’s flexible, supportive, and built to give you greater confidence during life’s more challenging moments.

Zig Ziglar Life Coaching

The Provider’s Zig Ziglar Life Coaching service partners individuals with certified coaches to set clear goals, tackle obstacles, and stay accountable on the journey to personal and professional growth. Through future-focused, structured conversations, clients discover their strengths and translate ambitions into actionable plans—whether it’s advancing a career, improving relationships, elevating health, or enhancing overall well-being.

Each participant receives six one-on-one coaching sessions annually, supported by unlimited access to Ziglar’s live webinars and interactive tools via our Providers app. This blend of executive coaching and behavioral-change counseling ensures continuous motivation, progress tracking, and skill building.

Key features include:

Personalized life assessments and improvement roadmaps

Targeted coaching on mindset shifts and habit formation

Executive-level strategy sessions for leadership and career success

Unlimited entry to Ziglar webinars for ongoing inspiration

Seamless session scheduling and resources through the QHB app

Partner with your Provider to bring Zig Ziglar Life Coaching to your benefits lineup—and empower your team to unlock potential, embrace growth, and lead more fulfilling live

The Problem with Traditional Benefits

Integrate more than 600 tools from your HR and benefits ecosystem easily and at your own pace with the open architecture and industrial-strength security capabilities of the Alight Worklife platform.

Unify your benefits ecosystem with the Alight Worklife® platform

Integrate more than 600 tools from your HR and benefits ecosystem easily and at your own pace with the open architecture and industrial-strength security capabilities of the Alight Worklife platform.

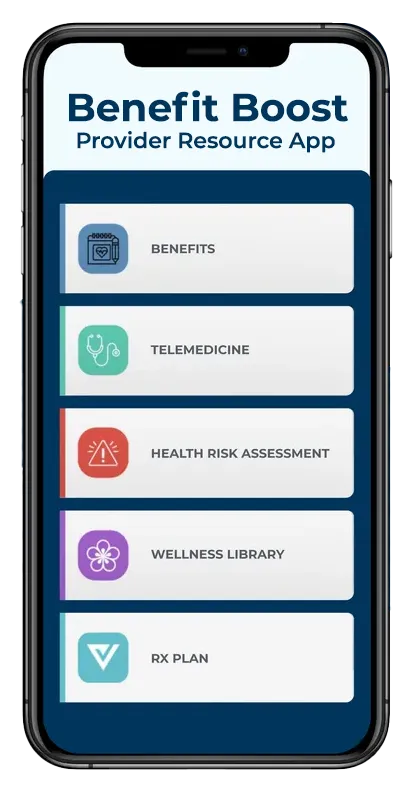

Easy Mobile App

With our mobile app, you can easily check up on your health and access the full suite of benefits

With our mobile app, you can easily check up on your health and access the full suite of benefits

Benefits

Easily Access your benefits anywhere.

Wellness Library

Quick access to great wellness information.

Telemedicine

Speak with licensed physicians 24/7.

Prescriptions

Easily access your medications anywhere.

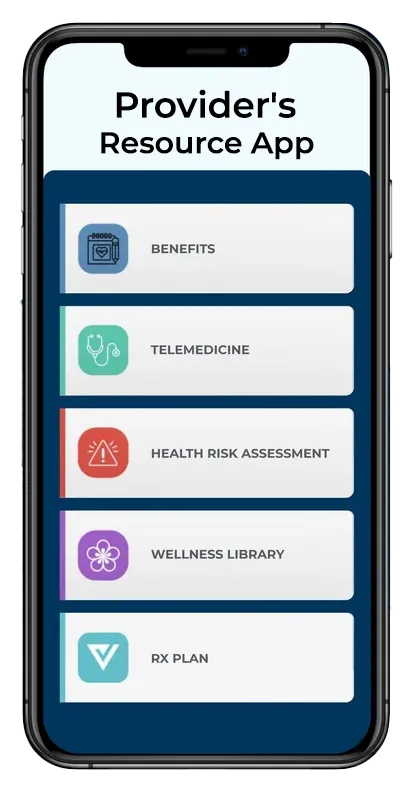

Benefits

Easily Access your benefits anywhere.

Wellness Library

Quick access to great wellness information.

With our provider's mobile app, you can easily check up on your health and access the full suite of benefits

Telemedicine

Speak with licensed physicians 24/7.

Prescriptions

Easily access your medications anywhere.

Unlock Peak Health & Savings with Benefit Boost Consulting

Benefit Boost Consulting helps you obtain a fully insured benefit suite includes virtual doctor access, prescription support, hospital indemnity, wellness programs, and more—boosting your workforce’s health and productivity while lowering expenses.

Ready to elevate your benefits at no extra expense?

Trusted by the world's best companies.

Trusted by the world's best companies.

We partner with 70% of the Fortune 100 and 50% of the Fortune 500 to transform the way they work. We administer benefits for over 35 million people and dependents, manage 200 million interactions annually and $1.2 trillion in assets.

Trusted by the world's best companies.

Trusted by the world's best companies.

We partner with 70% of the Fortune 100 and 50% of the Fortune 500 to transform the way they work. We administer benefits for over 35 million people and dependents, manage 200 million interactions annually and $1.2 trillion in assets.

Still have questions?

You can reach out to us and we'll gladly answer them for you.

Email: [email protected]

Phone (800) 401-8413

Or Schedule a 15 minute explainer call

Copyrights 2025, Benefit Boost Consulting ™ | Terms & Conditions | Privacy Policy